A Study on the Application of Asset Pricing Models in Global Markets

Asset pricing models play a fundamental role in finance, providing a framework for understanding the value of assets and securities in various markets. These models are crucial for investors, analysts, and institutions in making informed decisions about risk and return. While many asset pricing models have been developed over the years, their application varies significantly across different global markets due to variations in market structure, investor behavior, and economic conditions. This paper explores the key asset pricing models, such as the Capital Asset Pricing Model (CAPM), the Arbitrage Pricing Theory (APT), and multi-factor models, and examines their application in different global markets.

Overview of Key Asset Pricing Models

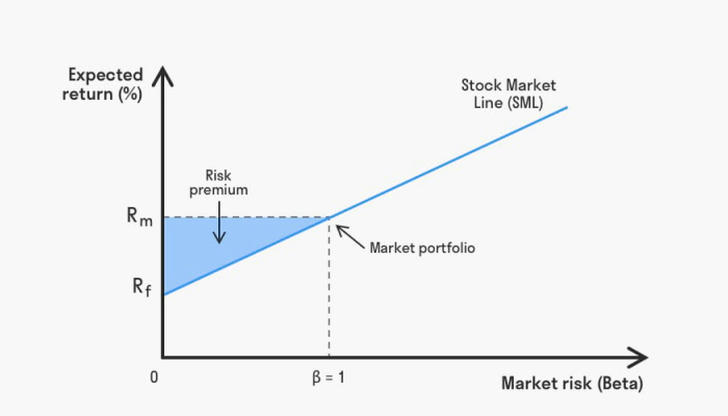

1.Capital Asset Pricing Model (CAPM) The Capital Asset Pricing Model (CAPM) is one of the most widely used asset pricing models. It provides a simple and intuitive method for calculating the expected return of an asset based on its risk relative to the market. According to CAPM, the expected return of an asset is determined by its risk-free rate, the asset's beta (which measures the asset's sensitivity to overall market movements), and the expected return of the market. The formula for CAPM is: E(Ri)=Rf+βi(E(Rm)−Rf)E(R_i) = R_f + \beta_i (E(R_m) - R_f)E(Ri)=Rf+βi(E(Rm)−Rf)

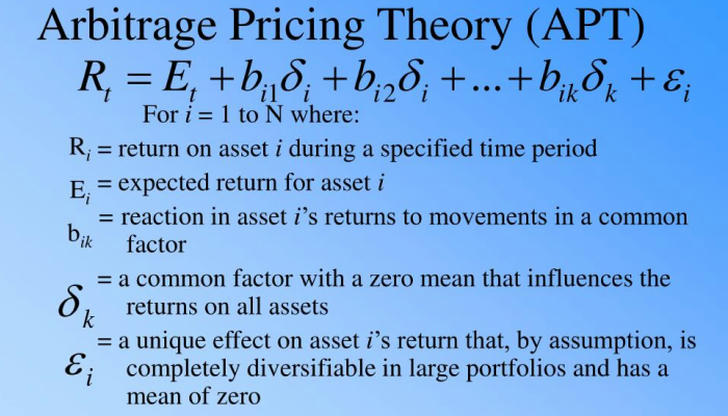

Where: •E(Ri)E(R_i)E(Ri) = Expected return of the asset •RfR_fRf = Risk-free rate •βi\beta_iβi = Asset's beta •E(Rm)E(R_m)E(Rm) = Expected return of the market 2. Arbitrage Pricing Theory (APT) The Arbitrage Pricing Theory (APT) is a more generalized approach to asset pricing. It relaxes the assumptions made by CAPM, such as the assumption of a single market factor, and instead uses multiple factors to explain asset returns. These factors can include inflation rates, interest rates, industrial production, and others, depending on the market being analyzed. The general formula for APT is: Ri=Rf+β1F1+β2F2+⋯+βkFk+ϵiR_i = R_f + \beta_1 F_1 + \beta_2 F_2 + \cdots + \beta_k F_k + \epsilon_iRi=Rf+β1F1+β2F2+⋯+βkFk+ϵi

Where: •RiR_iRi = Return on the asset •RfR_fRf = Risk-free rate •F1,F2,…,FkF_1, F_2, \dots, F_kF1,F2,…,Fk = Macro-economic factors •β1,β2,…,βk\beta_1, \beta_2, \dots, \beta_kβ1,β2,…,βk = Sensitivities to those factors •ϵi\epsilon_iϵi = Error term 3.Multi-Factor Models Multi-factor models extend the APT by considering a broader set of factors that may influence asset prices. These models often involve more complex statistical techniques to determine the significance and sensitivity of each factor. They can include both macroeconomic factors (e.g., GDP growth, interest rates) and microeconomic factors (e.g., company earnings, market sentiment). 4.Fama-French Three-Factor Model One of the most popular multi-factor models is the Fama-French Three-Factor Model, which adds two additional factors to the CAPM: size and value factors. The model posits that small-cap stocks tend to outperform large-cap stocks and that value stocks (those with low price-to-book ratios) tend to outperform growth stocks. The formula is: E(Ri)=Rf+β1(E(Rm)−Rf)+β2SMB+β3HMLE(R_i) = R_f + \beta_1 (E(R_m) - R_f) + \beta_2 SMB + \beta_3 HMLE(Ri)=Rf+β1(E(Rm)−Rf)+β2SMB+β3HML Where: •SMBSMBSMB (Small Minus Big) = Size factor •HMLHMLHML (High Minus Low) = Value factor

Application of Asset Pricing Models in Global Markets

1.Developed Markets In developed markets, such as the United States, Europe, and Japan, asset pricing models are widely used by institutional investors, mutual funds, and asset management firms. These markets are typically more efficient, with better access to information and more liquidity. However, even in these markets, the effectiveness of traditional models like CAPM can be questioned.

United States The U.S. market, with its robust financial infrastructure, has been a testing ground for many asset pricing models. The CAPM is commonly used, but its limitations, particularly the assumption of a single factor (market return), have prompted the adoption of multi-factor models like the Fama-French Three-Factor Model. Moreover, the increasing importance of intangible assets and technological innovation has led researchers to develop models that incorporate factors like innovation and technology-driven growth. While the CAPM can still provide useful insights, it is often complemented by more sophisticated models that account for the complexity of modern financial markets. Europe In Europe, the application of asset pricing models has been influenced by the diversity of markets across the region. While larger economies like Germany, France, and the United Kingdom follow similar patterns to the U.S. in terms of using CAPM and multi-factor models, smaller or emerging markets in Eastern Europe may face challenges in implementing these models effectively. These markets often experience lower liquidity, greater market inefficiencies, and more significant regulatory and political risks, which can affect asset pricing. Japan Japan’s equity market has also been analyzed using traditional models like CAPM and multi-factor models. However, the Japanese market has unique characteristics, such as the importance of cross-shareholding between corporations and government intervention in market activities, which can make asset pricing more difficult to model. The Fama-French Three-Factor Model has been applied in Japan, but the model’s effectiveness can be limited due to the country’s distinct corporate culture and market dynamics. 2.Emerging Markets Emerging markets, such as those in Asia, Latin America, and Africa, often exhibit higher levels of volatility and less efficiency compared to developed markets. In these markets, the application of asset pricing models presents additional challenges, as macroeconomic factors such as political instability, inflation, and exchange rate fluctuations can significantly affect asset prices. China The Chinese stock market is an example of an emerging market where traditional asset pricing models like CAPM are often inadequate due to the government’s influence on the market, limited investor sophistication, and high levels of speculation. In China, investors tend to focus heavily on sentiment and government policies, which can make models based solely on market returns and risk-free rates less effective. However, multi-factor models that include factors such as economic growth, industrial policies, and state-owned enterprises’ performance may offer more useful insights. India In India, the stock market has become increasingly attractive to foreign investors, but it remains subject to significant volatility. In this context, models like APT and Fama-French’s multi-factor models have been found to be more effective than CAPM in capturing the complexity of returns. Factors such as inflation, interest rates, and fiscal policies are important drivers of returns in India, and incorporating these factors into asset pricing models improves their predictive power. Brazil and Latin America In Brazil and other Latin American countries, political risk and macroeconomic instability are prominent concerns for investors. Asset pricing models that account for these risks, such as APT or multi-factor models, have shown greater efficacy than CAPM in these regions. The inclusion of country-specific risk factors, such as inflation, currency fluctuations, and political events, helps to improve model predictions. 3.Frontier Markets Frontier markets, which are typically even less developed than emerging markets, present the most significant challenges in applying asset pricing models. These markets often suffer from extreme volatility, low liquidity, and a lack of reliable data. For instance, countries in Sub-Saharan Africa and parts of the Middle East have seen rapid economic growth but also face challenges like political instability and weak financial systems. Traditional models like CAPM are less applicable here, and models that incorporate local economic and political factors are more useful.

Limitations and Challenges of Asset Pricing Models

Despite their widespread use, asset pricing models face several limitations, especially in global markets: •Market Inefficiency: In many markets, especially emerging and frontier markets, inefficiencies and anomalies exist that cannot be captured by traditional models. Behavioral factors such as investor sentiment, market speculation, and herding behavior can significantly impact asset prices. •Data Availability: Reliable data is crucial for the accurate application of asset pricing models. In emerging and frontier markets, data is often sparse, unreliable, or unavailable, making the application of these models challenging. •Model Assumptions: Many asset pricing models, especially CAPM, rely on assumptions that may not hold in practice, such as perfect market conditions, rational investors, and risk-free borrowing. These assumptions are often violated, especially in volatile markets.

Conclusion

The application of asset pricing models in global markets varies significantly based on the market’s level of development, investor behavior, and economic conditions. In developed markets like the U.S. and Europe, traditional models like CAPM and multi-factor models such as the Fama-French Three-Factor Model are widely used and generally effective. However, in emerging and frontier markets, where market inefficiencies, volatility, and political risks are more prevalent, asset pricing models often require adaptation to incorporate local factors. While no single model can perfectly predict asset prices across all global markets, a thoughtful combination of models that account for market-specific factors can provide investors with more reliable insights and better risk management strategies.